The Art of

Precise Filing.

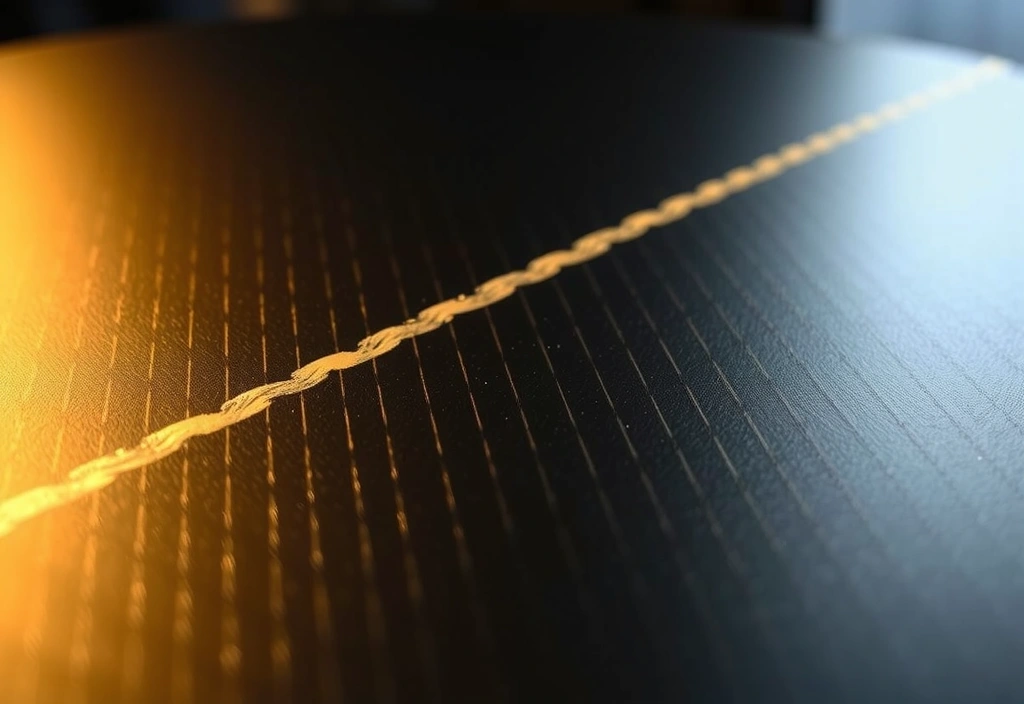

Universal tax software treats your financial life like a ready-to-wear suit: functional, but rarely a perfect fit. We approach US tax filing as a discipline of precision, where the nuance of a single deduction aligns like a master-tailor’s stitch.